It’s critical to comprehend the Philippine 13th month pay law before hiring personnel there. To learn everything you need to know in just five minutes, continue reading.

Every December, thousands of workers in the Philippines look forward to their 13th month salary. However, it is more than just a nice Christmas bonus from the company; it is a requirement imposed by the law.

It’s essential to comprehend your responsibilities as an employer if you’re preparing to build out a workforce or hire personnel in the Philippines. You must understand what 13th month pay is, who is entitled to get it, and how to compute it. If not, you run the danger of not complying.

This article offers you a hassle-free alternative to handling compliance on your own and gives all the information you need about the 13th month pay rule in the Philippines.

What Does the Philippines’ 13th Month Pay Law Consist Of?

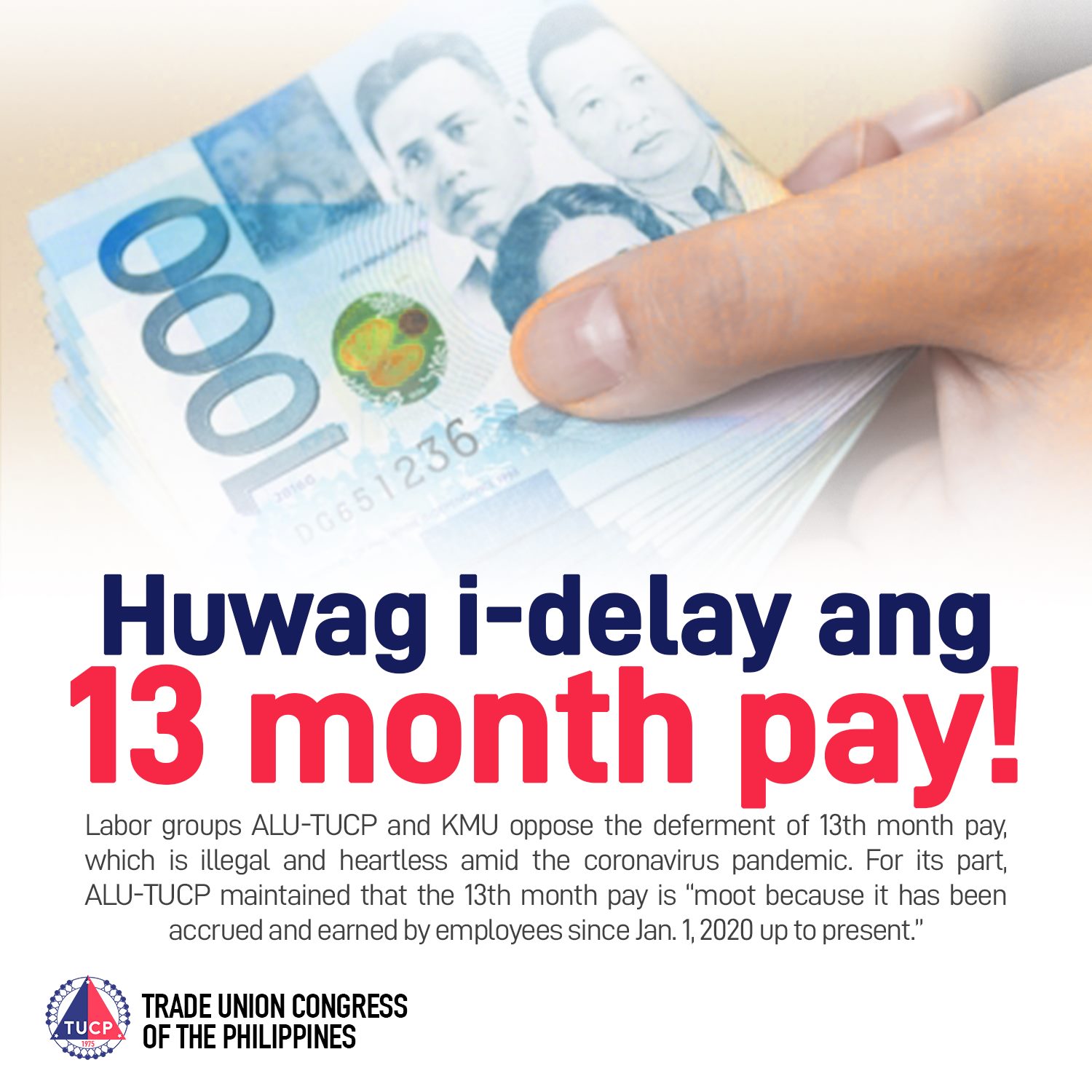

Employees in the Philippines are required to get 13th month salary at the conclusion of the calendar year. Although it could resemble a Christmas bonus, 13th month pay is a mandatory benefit required by employment law, thus companies must provide it.

Employers are required to pay eligible workers their 13th month’s wages by December 24 of each year. Employers can choose to pay it in two installments instead of one lump sum, often in June and December. Employees have the right to sue if they don’t pay the 13th salary on time or at all.

In 1975, President Ferdinand Marcos’ Presidential Decree No. 851 included the 13th month pay provision. It sought to address problems with the minimum wage, which was out of line with living expenses. Since then, it’s been covered by Philippine legislation.

Although the Philippines is sometimes cited as one of the first nations to require 13th month compensation, the idea was really developed in Europe well before the 1970s. It is currently accepted practice on a global scale, both as a requirement of law and as an accepted tradition.

Christmas Bonus vs. the 13 Month’s Pay

In the Philippines, there is a legal distinction between a Christmas bonus and 13th month salary. A Christmas bonus is money provided to an employee in excess of what the law mandates as a reward or incentive for their success, as opposed to the 13th month paycheck, which is a requirement that is enforced by Philippine law. In December, some employers might give both kinds of payouts.

Who’s Eligible for 13th Month Pay in the Philippines?

According to the Department of Labor and Employment (DOLE) guidelines, all private-sector “rank-and-file” employees are eligible for the 13th month pay benefit as long as they’ve worked for at least one month during the calendar year.

“Rank-and-file” includes all workers who are not in managerial positions, so those who have the authority to hire, discipline, and discharge employees aren’t entitled to 13th month pay.

As long as the above conditions are met, employees must receive 13th month pay, even if they’ve resigned or been terminated before the time of the payment.

Currently, there’s no entitlement to 13th month pay for government employees. This includes employees of government-owned and controlled corporations but excludes corporations “operating essentially as private subsidiaries of the Government.”

You can read more about eligibility for 13th month pay on the Philippine government website.

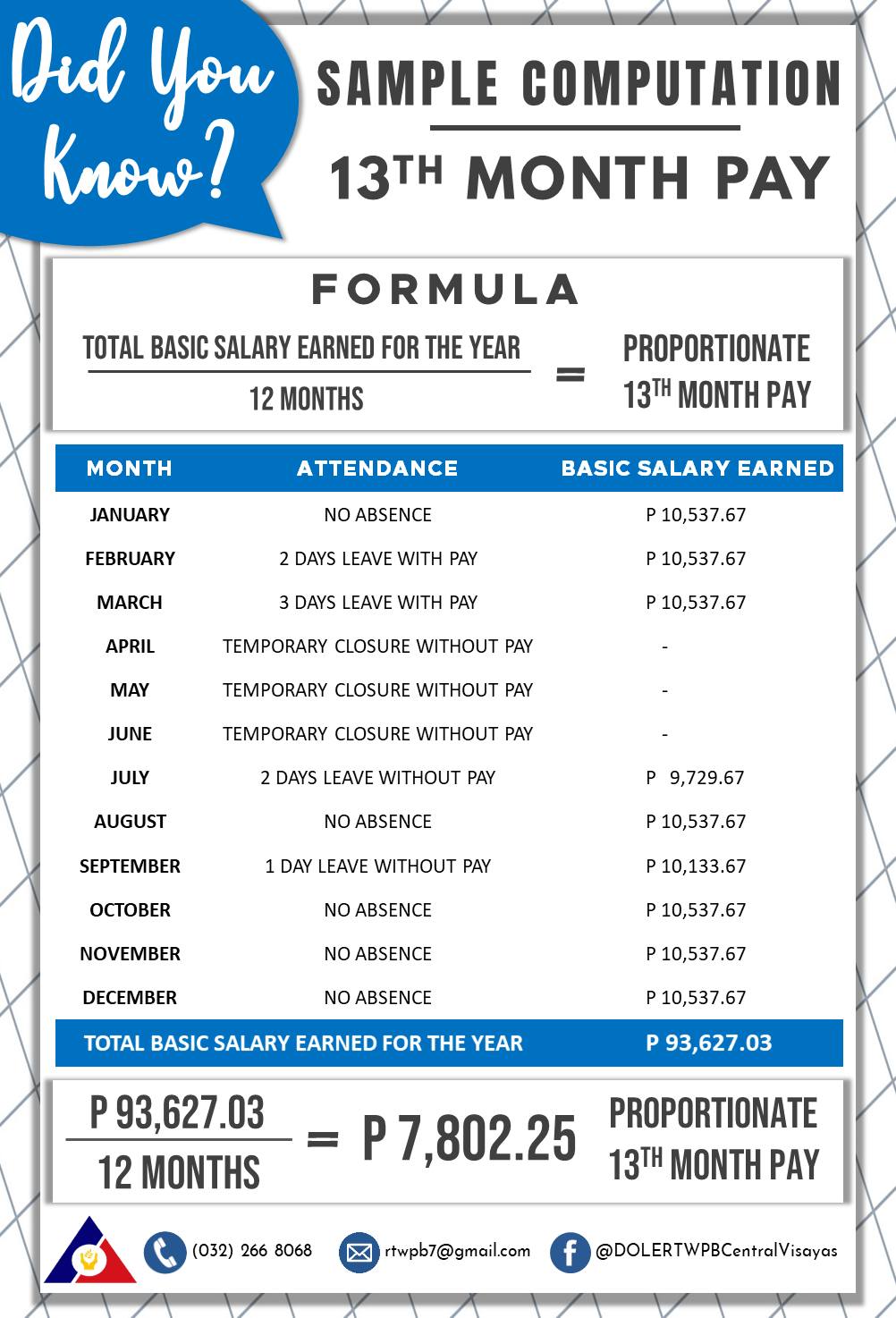

Computation of 13th Pay in the Philippines

Computing statutory 13th month pay in the Philippines is fairly straightforward. You just need to know the employee’s basic salary and then divide it by 12.

Basic salary includes all regular earnings paid to an employee, excluding allowances and monetary benefits that aren’t considered to be part of regular pay. For example, sick leave, overtime, and holiday pay aren’t included in 13th month pay calculations, nor are maternity leave benefits.

Here’s the Philippines’ 13th month pay formula to help you out:

Total basic salary per annum (minus unpaid absences) / 12 = 13th month pay

For example, if an employee earns PHP 240,000 per year and hasn’t taken any unpaid days off, their 13th month pay would be PHP 20,000 (240,000 ÷ 12 = 20,000).

However, computation of 13th month pay in the Philippines is a little different if an employee joins or leaves the company part way through the year. In this case, you would compute 13th month pay by dividing accrued salary to date by 12, not the total annual salary.

Let’s use the example of the employee above who earns PHP 240,000 per year, and let’s say they will have only been working for the company for exactly four months by December 31. First, multiply their basic monthly salary by the number of months worked (PHP 20,000 x 4 = PHP 80,000), then divide that figure by 12 (PHP 80,000 ÷ 12 = PHP 6,666.67). That’s their pro-rata 13th month pay.

Is 13th Month Pay Taxable in the Philippines?

Yes, 13th month pay is taxable in the Philippines if it exceeds PHP 90,000 (~$1714). If an employee’s 13th month pay is below the threshold, they will receive the salary in full, tax-free.

Prior to 2018 and the signing of the Tax Reform for Acceleration and Inclusion (TRAIN) law, the threshold was PHP 82,000. The TRAIN law lowered personal income tax and raised consumption tax.

IMAGE SOURCES: TUCP, FILIPIKNOW

ADDED SOURCES: OMNIPRESENT.COM