With the launch of a mobile payment app that connects directly to the client’s BDO account and credit card, BDO UNIBANK has expanded the range of digital banking channels available to its customers, making banking even more practical, secure, and attentive to their needs.

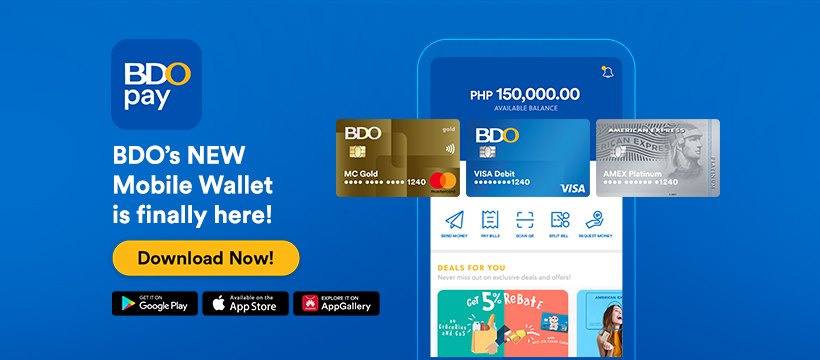

This program, known as BDO Pay, will allow users to make contactless payments for bills to online merchants and a variety of stores around the country using their savings account or credit card.

According to BDO, “the digital initiatives center not only around technical infrastructure but also the redesign of operational procedures and the hiring of professionals to enable the bank to be more nimble and responsive to the needs of its consumers.”

According to BDO, “the digital initiatives center not only around technical infrastructure but also the redesign of operational procedures and the hiring of professionals to enable the bank to be more nimble and responsive to the needs of its consumers.”

Clients of BDO no longer have to switch between several apps in order to transfer money from one account to another thanks to this most recent initiative. A mobile payment app that is immediately connected to a client’s bank account also spares the latter from having to continually pay cash-in fees.

Customers of BDO who already have an online banking account can utilize BDO Pay by installing the appropriate mobile app from Google Play, the App Store, or Huawei AppGallery. Existing customers who have not yet have an online banking account are urged to enroll first by signing up on online.bdo.com.ph. Customers can download and use the BDO Pay app as soon as their online banking account is activated.

Open a BDO account if you’re not already a customer to access the functionality of the aforementioned mobile payment app.

BDO has been improving its technology and security infrastructure to deliver its products and services to customers in a faster, easier, and more secure manner. BDO presently runs the most branches and ATMs in the nation.

Since they give BDO clients quick access to all of their BDO accounts, including credit cards, deposits, loans, and investments, BDO Online Banking and Mobile Banking saw a significant spike in usage during the height of the pandemic.

In large part because of COVID-19, the global adoption of the mobile and online banking habit is increasing quickly. As a result, banks are now embracing the benefits of digital banking and enabling their customers to conduct bank transactions and make payments without having to go to a branch.

In the Philippines, cashless transactions and online banking are becoming more and more commonplace among the populace. Targets of the Bangko Sentral ng Pilipinas (BSP)

According to public statements of condition as of March 31, 2021, BDO was the largest bank in terms of total assets, loans, deposits, and trust funds managed.

With more than 1,400 consolidated functioning branches and more than 4,400 ATMs located all throughout the nation, it has the greatest distribution network in the nation. It also has 16 overseas locations in Asia, Europe, North America, and the Middle East, including full-service branches in Singapore and Hong Kong.

IMAGE SOURCES: BDO