Nowadays, it’s possible to do amazing things through anyone’s smartphones. You can talk to whoever you like anywhere in the world, play music, games whenever you want and search anything online in the blink of an eye. The most latest and a life charger in digital development is the e-wallet, of which the Philippines is is quite familiar to it to thanks to GCash.

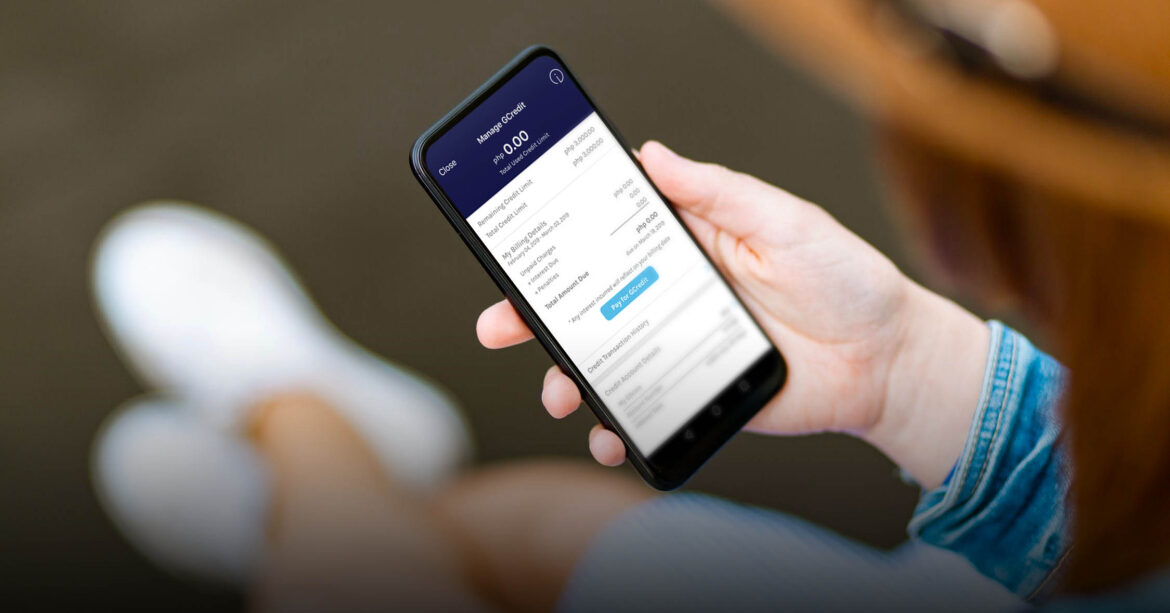

GCash is a local app that you can install on any of your devices like smartphones or tablets. It allows you to pay your purchases, bills, services and even send or receive money wherever you are. Mobile wallet GCash and convenience store giant 7-Eleven team up to provide convenienceto their loving customers.The said partnership allows GCash users to pay for their purchasesin stores of 7 eleven via scan-to-pay (STP) via barcode in the GCash app.

To use GCash’s STP, 7-Eleven customers only need to set up the given barcodes through the GCash app and allow the cashier to scan the barcodes to complete the transaction.

With STP via barcode merchants do not need QR key code, which the customer scans to transact.

Merchants also do not need to have their own mobile devices to verify the payments, the STP via barcode is will do the merchant’s point-of-sales, GCash said.

“We are pleased to partner first with GCash, whom we have been working with for several years. Many customers already visit us to cash-in their GCash wallets, now they can use those same wallets to pay for their purchases as well as participate in our CLiQQ loyalty program,” 7-Eleven president and chief executive officer Jose Victor Paterno said.

The STP via barcode is now available in more than 2,800 7-Eleven stores in the country. It is also available in majority of Puregold outlets and Starbucks stores nationwide.

GCash, which is operated by Globe Fintech Innovations Inc., said the partnership with the convenience store chain also supports the Bangko Sentral ng Pilipinas’ goal of creating a more cashless Philippines starting this year by migrating 20 percent of the total transactions to non-cash means such as digital payments.

Based on a study conducted by the Better Than Cash Alliance, a United Nations-backed organization, digital transactions account for 20 percent of the total value of transactions and 10 percent in terms of volume in 2018.

Thomas said GCash plans to continue pushing for the development of its platform this year to enable more people to participate in the digital financial revolution.

“As a strong government partner and leader in mobile digital payments, we at GCash remain relentless in developing more products and services that will fit perfectly into the government’s plans for the country’s financial landscape,” he said.

The hours that you saved, you can invest in the things that matters more like your family, friends, love ones, hobby, or anything else!

Photo courtesy: Viva Manilena, megabites, CORNER MAGAZINE PH, Ayala