Citibank introduced a new digital service that aims to help the Bangko Sentral ng Pilipinas (BSP) by transforming the Philippines from cash-heavy to cashless banking.

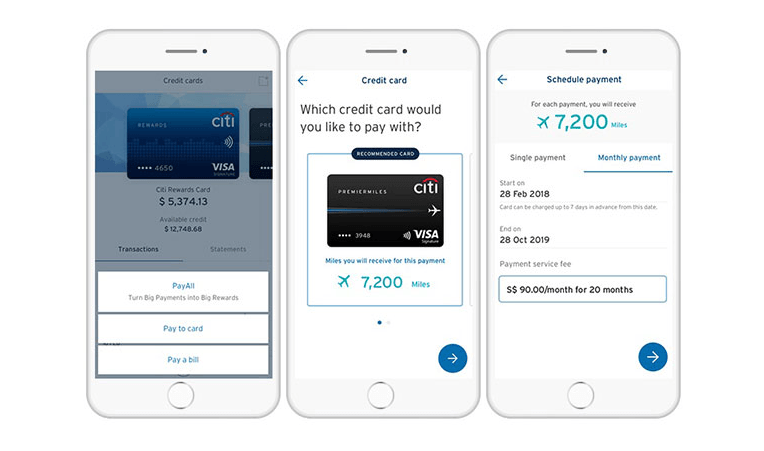

Citi PayAll is a service that enables Citi cardholders to make payments to various Payees using a Citi credit card. It has several payments – such as school fees, rent, membership / association fees, retainer / professional fees, and insurance premiums for just a small fee. These transactions also allows the consumer to earn miles, points, or rebates.

Also, Citi PayAll empowers credit cardholders to seamlessly use their credit card to make these payments directly to any local bank and is the first bank across Asia Pacific to offer this capability on mobile phones.

Customers have a maximum limit of P200,000 per transaction and will incur a per transaction fee of up to three percent. Citi credit cardholders can make up to six transactions a month with up to P1 million aggregate amount.

According to Citi Philippines chief executive officer Aftab Ahmed, the bank continues to support the financial inclusion efforts of the government as well as the central bank.

“We are very much solid in supporting the central bank and the government in its inclusion and digitalization efforts. And we are very much committed to achieving the 20, 30, 40, 50 percent number in the coming years,” Ahmed said.

By 2023, BSP Governor Benjamin Diokno is confident, that half of total transactions in terms of volume and value would be digitalize.

In the latest survey conducted by the United Nation’s Better Than Cash Alliance (BTCA) showed the share of digital payments increased to 10 percent in 2018 from one percent in 2013 in terms of volume and to 20 percent from eight percent in terms of value.

Citi Philippines consumer banking head Manoj Varma said the first-of-its-kind Citi PayAll allows credit cardholders to pay for big transactions usually paid for via check or cash through their mobile phones.

The innovation also gives clients more autonomy and flexibility in payment options and provides greater convenience in big rewards.

Sources: citibank.com.ph, citigroup.com, philstar.com

Photo Sources: emerging-europe.com, citigroup.com